This is a difficult question to answer definitively because it is unclear what exactly you are asking. Are you asking if Elon Musk, the CEO and founder of Tesla and SpaceX, pays taxes in general? Are you asking if he pays personal income taxes? Are you asking if his companies pay corporate taxes?

However, we can try to provide some clarity on the subject. First, it is important to note that, as an individual, Elon Musk does pay taxes. He has said as much in an interview with CBS news. In terms of his businesses, it is less clear. Tesla, for example, has been granted over $5 billion in tax breaks and incentives by local and state governments. Additionally, while SpaceX is a private company and therefore not required to disclose its financial information, it is widely believed that the company pays little to no taxes.

So, in short, it seems that Elon Musk does pay taxes, but his businesses likely don’t pay much in the way of taxes.

Elon Musk does not pay taxes.

How much money did Elon Musk have to pay in taxes?

This is a difficult topic to determine since only the IRS would have the most accurate information. However, Forbes suggests that Elon Musk is actually telling the truth when he said he owes the federal government at least $83 billion for 2021. This figure is much higher than what Business Insider has reported. It’s hard to say for certain without more information from the IRS, but it’s possible that Musk is being truthful about his tax debt.

Tesla’s annual income taxes have seen a huge increase over the past few years. In 2022, they were up 6195% from 2021. This is a huge increase and shows that Tesla is doing very well financially. They are able to pay more in taxes because they are making more money. This is good news for the company and shareholders.

How do the rich not pay taxes

The step-up basis is a fundamental way wealthy people avoid paying taxes when their investments increase in value. When an asset is sold at a profit, it’s taxed. However, if the asset isn’t sold but instead passed on to an heir, then the asset’s value is adjusted to its worth at the time of the death. This allows the heir to avoid paying taxes on the increased value of the asset.

It is clear that high-income taxpayers paid the majority of federal income taxes in 2020. This is due to the fact that the bottom half of taxpayers earned only 102 percent of total AGI, while the top 1 percent earned 222 percent of total AGI. As a result, the top 1 percent paid 423 percent of all federal income taxes.

Why did Tesla pay 0$ in taxes?

Tesla will not be paying any federal taxes this year, as the company’s recent filing with the Securities and Exchange Commission shows that its federal tax bill for the year sum totalled nothing. This is likely due to the EV company’s strong financial performance in recent years, which has allowed it to accumulate a significant amount of tax credits. However, it is worth noting that Tesla still faces a sizable state tax bill, which could come as a surprise to many taxpayers.

The wealthiest 400 billionaire families in the US paid an average federal individual tax rate of just 82 percent in 2021, according to a White House study. For comparison, the average American taxpayer in the same year paid 13 percent. This is a huge disparity that needs to be addressed. The wealthy should not be paying such a low rate while the average American is paying nearly seven times as much. This is unfair and unjust. The wealthy should be paying their fair share, and the government should close the loopholes that allow them to get away with paying such low rates.

Why did Tesla pay no taxes?

Tesla avoids paying federal taxes by insisting that all of its profit comes from overseas. The company says that its US operations lose money, so it does not owe any federal taxes under the terms of the tax code. This avoidance of taxes is legal, but it raises questions about Tesla’s commitment to its home country.

The Wealth Tax was a new progressive tax introduced by President Franklin D Roosevelt as part of his New Deal programs. The tax took up to 75 percent of the highest incomes, with the intention of generating needed funds to support the programs. However, many wealthy people were able to use loopholes in the tax code to avoid paying the tax.

Who pays more in taxes rich or poor

The federal tax system is generally progressive, meaning that tax rates are higher for wealthy people than for the poor. This means that the people who pay the most in federal taxes are typically the wealthier individuals.

The American tax code is highly imbalanced, and this often results in millionaires and billionaires paying lower tax rates than middle class workers. This is a major problem, as it means that the wealthy are not contributing their fair share to the running of the country. This needs to be addressed urgently in order to create a more level playing field.

Who pays the lowest taxes in the US?

Sales taxes in Alaska are some of the lowest in the country, with a rate of only 176%. This makes it a great place to shop for items that may be subject to sales tax. Oregon, Delaware, Montana, and New Hampshire all have zero percent sales tax rates, making them some of the most tax-friendly states in the country.

There is no personal income tax in Alaska, making it a very attractive state for residents. Wyoming, Washington, Texas, Tennessee, South Dakota, Nevada, Florida, and Alaska all have no personal income tax. This means that residents of these states can keep more of their hard-earned money.

If you’re a senior citizen and your annual income is below a certain threshold, you’re exempt from paying taxes. The specific thresholds vary depending on your age and marital status, but in general, seniors who earn less than $19,400 (if under 65) or $21,150 (if 65 or older) are not required to pay any taxes. This policy provides much-needed relief to low-income seniors, who are often on a fixed income and struggling to make ends meet.

What states have no income tax

Nine states in the US have no income taxes, although some of them may tax other forms of income. New Hampshire is one of these states, but it is phasing out its tax on interest and dividends. This change will begin in 2024 and be completed in 2027.

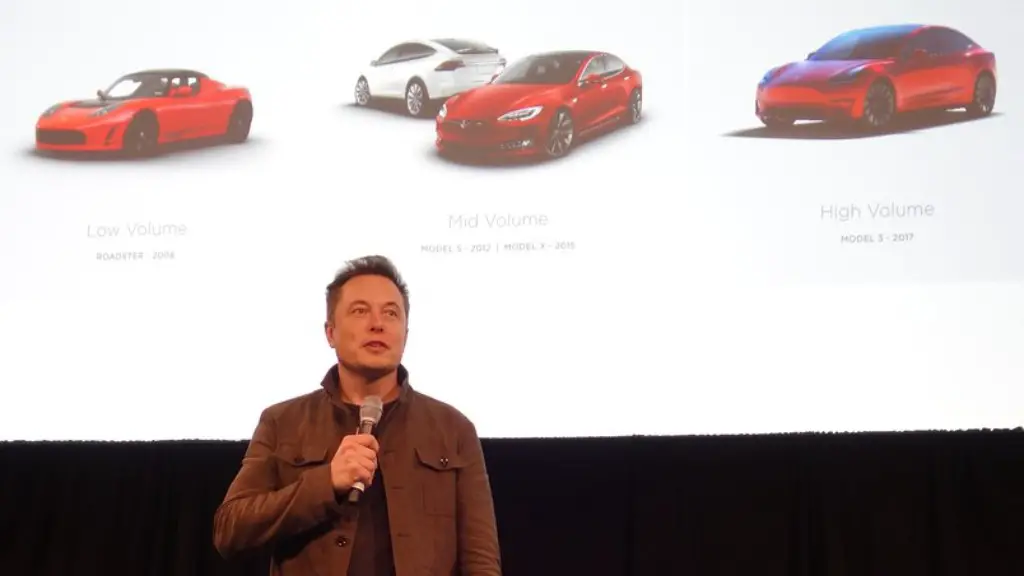

Elon Musk is one of the richest men in the world, with a net worth of over $228 billion. He is the founder and CEO of Space X and Tesla, and has a monthly income of over $200 million. In 2023, he will be one of the most eligible billionaires in the world, with an estimated yearly income of $2400 million. Musk is an amazing example of what one can achieve with hard work and determination.

How much money does Mark Zuckerberg pay in taxes?

These are just a few of the many notable names that have paid a lower tax rate than the standard 2% based on their wealth growth. While some may view this as unfair, it’s important to remember that these individuals have likely contributed a significant amount of money to the economy and have created jobs and opportunities for others.

Musk has refuted the claims made by the Massachusetts senator, saying that he not only pays taxes, but made history with his tax payments last year. Musk has owed $11 billion in taxes after trading Tesla shares.

Warp Up

Elon Musk, the founder, CEO and CTO of SpaceX, co-founder of Tesla Motors, and chairman of SolarCity, definitely pays taxes. He is estimated to have a net worth of $13.9 billion, so he likely pays a significant amount in taxes every year.

Yes, Elon Musk pays taxes. He is the founder, CEO and CTO of SpaceX, co-founder of Tesla Motors, and chairman of SolarCity. As of 2012, his net worth was estimated to be $2.7 billion. He is also the founder of The Boring Company, a tunnel construction company.