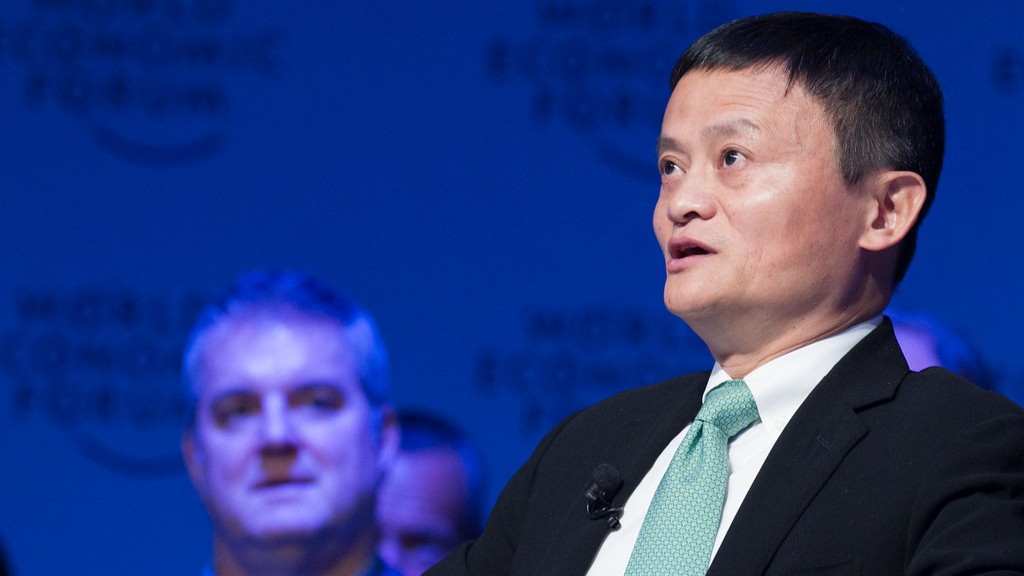

In Ma’s early years as an entrepreneur, he and his partners started a number of companies including an import-export business, a publishing house, and a website design firm. One of their most successful ventures was a website called Alibaba, which helped connect Chinese manufacturers with buyers around the world. When Alibaba went public in 2014, Ma owned about a third of the company. As of 2019, his net worth was estimated to be $41.8 billion.

In order to split equity fairly, Jack Ma used a mathematics approach known as the Kelly Criterion. This approach considers both the amount of money invested and the amount of time until the investment will be liquidated. Jack Ma applied the Kelly Criterion to Alibaba’s equity structure and came up with a split that he believed to be fair for all parties involved.

What percentage of Alibaba does Jack Ma own?

Ma’s indirect control over Ant Group has been reduced from 5346 percent to 62 percent following a share adjustment. This makes him no longer the company’s “control person.” However, he still holds a significant stake in the company and will likely remain influential.

Jack Ma, the founder of Alibaba, was looking for investors to help fund his company. He carefully selected the candidates and rejected 38 VC providers. He finally decided on several fund companies, including Goldman Sachs, who injected $5 million to help Alibaba through the dilemma.

Ma still owned a 89% stake in the company at the time Chinese regulators said they were investigating Alibaba Group Holdings Ltd over “suspected monopolistic practices” And on Dec 28, China told Ant Group to limit its ambitions and focus on payment services instead of insurance or wealth management.

This means that Ma still has a lot of control over the company, even though the Chinese government is cracking down on Alibaba’s business practices. It’s not clear what will happen next, but it’s clear that Ma is still a powerful force in the company.

Japan’s SoftBank is believed to be Alibaba’s (BABA) largest shareholder, owning around 24% of the company.

Who owns the most stocks in the world?

Microsoft is a great stock pick for the world’s wealthiest person because it is a giant tech company that is constantly innovating and expanding its reach. Gates still owns almost 103 million shares of the company, which is worth $154 billion. Microsoft is a safe pick for anyone looking to invest in a stable company with a bright future.

Jack Ma, the founder of Alibaba Group, has resurfaced in Tokyo after a two-year absence from the public eye. The Financial Times reports that Ma has been keeping a low profile since his run-in with the authorities in China. It is not clear what Ma is doing in Tokyo, but the Financial Times notes that he has been spotted at business meetings and social gatherings.

Jack Ma’s ownership stake in Alibaba has decreased over the past two years, going from 62 percent in 2019 to just 45 percent in 2021. This is due to Ma selling off some of his shares in the company. Even with this decrease in ownership, Ma remains the largest individual shareholder in Alibaba.

While Amazon and Alibaba may have different market shares in different countries, they both dominate the ecommerce markets in which they began. Both companies have built their businesses by offering low prices and a wide variety of products, which has allowed them to attract and retain customers. Additionally, both companies have been able to expand their businesses by expanding into new markets and offering new services.

Was Jack Ma the richest man in China

According to Bloomberg Billionaires Index, Ma’s fortune peaked at $666 billion in October 2020 when Alibaba shares traded at an all-time high. Ma was formerly China’s wealthiest man, a title now held by beverage mogul Zhong Shanshan.

The top 10 owners of Uber Technologies Inc. stock are as follows:

1. Morgan Stanley Investment Management – 571% (113,969,296 shares)

2. The Vanguard Group, Inc – 570% (113,743,771 shares)

3. Fidelity Management & Research Co – 500% (99,712,717 shares)

4. BlackRock Fund Advisors – 288% (57,441,683 shares)

5. SoftBank Group Corp – 277% (54,956,627 shares)

6. T. Rowe Price Associates, Inc – 168% (33,768,007 shares)

7. Dragoneer Investment Group LLC – 133% (26,397,975 shares)

8. Menlo Ventures LLC – 106% (21,201,854 shares)

9. Coatue Management LLC – 82% (16,413,953 shares)

10. Sherpa Capital LLC – 56% (11,165,302 shares)

Is Alibaba bigger than Walmart?

2 positions on the National Retail Federation’s annual list of the world’s largest retailers, while Alibaba Group has dropped out of the top 10 for the first time since the list was first compiled in 2003.

Alibaba is a Chinese multinational conglomerate specializing in e-commerce, retail, Internet, and technology. Founded in 1999 by Jack Ma, Alibaba is one of the world’s largest online and mobile commerce companies. The company does not pay a dividend.

Who is richer Alibaba or Amazon

Analysts expect Amazon to generate more than three times as much revenue as Alibaba this year. Amazon’s market cap of $17 trillion dwarfs Alibaba’s market cap of approximately $333 billion. This is a huge difference and it is expected that Amazon will continue to dominate the market.

Berkshire Hathaway Inc is a publicly traded company with shares owned by various stakeholders. The Vanguard Group, Inc is the largest shareholder with over 1013% stake in the company. BlackRock Fund Advisors is the second largest shareholder with 574% stake. SSgA Funds Management, Inc is the third largest shareholder with 553% stake.

Who owns the most Berkshire Hathaway?

Warren E Buffett is one of the top shareholders of Berkshire Hathaway class B shares. He is also the chairman, president, and CEO of Berkshire Hathaway. He is one of the most successful investors in the world.

The largest daily percentage gains are as follows:

1. 1933-03-15 +82.62%

2. 1931-10-06 +12.86%

3. 1929-10-30 +28.40%

There have been many large percentage gains over the years, but these three days stand out as the biggest. It’s interesting to note that all of them occurred during bear markets.

Conclusion

Jack Ma reportedly handed out equity in Alibaba Group to employees early on in the company’s history. He is said to have given out around one-fifth of Alibaba’s shares to employees, and kept 80 percent for himself and other founders. This helped to align employees’ interests with those of the company, and created a large group of owners with a vested interest in Alibaba’s success.

Jack Ma initially offered 33% equity to potential investors, but later revised the amount to 20% after speaking with venture capitalists. He did this in order to maintain a larger stake in the company, which he felt was important for its future success.