In 2014, Alibaba Group chairman Jack Ma owned 8.8% of Alibaba Group, making him the single largest shareholder. As of 2018, Ma’s stake in Alibaba had decreased to 6.3%, still making him the largest individual shareholder.

Jack Ma, the founder and executive chairman of Alibaba Group, one of the world’s largest e-commerce companies, owns a significant amount of Alibaba Group stock. It is estimated that Ma owns about 17% of Alibaba Group, which would give him a net worth of approximately $50 billion as of October 2019.

PRIMECAP Management Co, HSBC Global Asset Management (UK) Ltd, E Fund Management Co, Ltd, and SoftBank Group Corp are all asset management companies. They specialize in different areas, such as stocks, bonds, and mutual funds.

Alibaba owns a roughly 33% stake in Ant Group, and Ant said Saturday that Ma would no longer control the company. It’s the latest move in a reorganization of the fintech giant to assuage Chinese regulators who forced it to abandon its plans for a public listing in 2020.

Is Alibaba bigger than Amazon

There are many similarities between Amazon and Alibaba. Both companies are leaders in ecommerce in their respective countries. They both began as online marketplaces and have since expanded into other areas such as cloud computing and artificial intelligence. Both companies are also known for their innovation, customer focus, and large scale.

There is no one perfect way to write a note. However, there are a few general tips that can help you get started:

– Keep it short and to the point. A note should be a brief message that conveys your thoughts or feelings.

– Be clear and concise. Be sure to use language that is easy to understand.

– Be respectful. Even if you are conveying a negative message, it is important to be respectful of the person you are addressing.

– Use proper grammar and punctuation. This will help ensure that your message is clear and easy to understand.

Is Alibaba bigger than Walmart?

2 positions in the top 50 global retailers for 2019, according to a new report. Alibaba, meanwhile, has dropped out of the top 10 for the first time since the list was first published in 2006.

The annual ranking by Deloitte Touche Tohmatsu Ltd. and STORES magazine looks at the world’s largest retailers by revenue.

Walmart’s revenue for the fiscal year ended Jan. 31, 2019, was $514.4 billion, up from $500.3 billion the previous year. Amazon.com Inc.’s revenue for 2018 was $232.9 billion, up from $177.9 billion the previous year.

Alibaba’s revenue for the fiscal year ended March 31, 2019, was $39.9 billion, down from $56.1 billion the previous year.

The top 10 retailers on the list are:

1. Walmart

2. Amazon

3. The Kroger Co.

4. Costco Wholesale Corp.

5. Albertsons Companies Inc.

6. Ahold Delhaize

7. The Home Depot Inc.

8. Target Corp.

9. Lowe’s Companies Inc.

Analysts expect Amazon to generate more than three times as much revenue as Alibaba this year. Amazon’s market cap of $17 trillion dwarfs Alibaba’s market cap of approximately $333 billion. This is due to the difference in size between the two companies. Amazon is a much larger company than Alibaba, and it has a much broader range of products and services. Alibaba is a smaller company, and it focuses mainly on e-commerce.

Why is Alibaba owner missing?

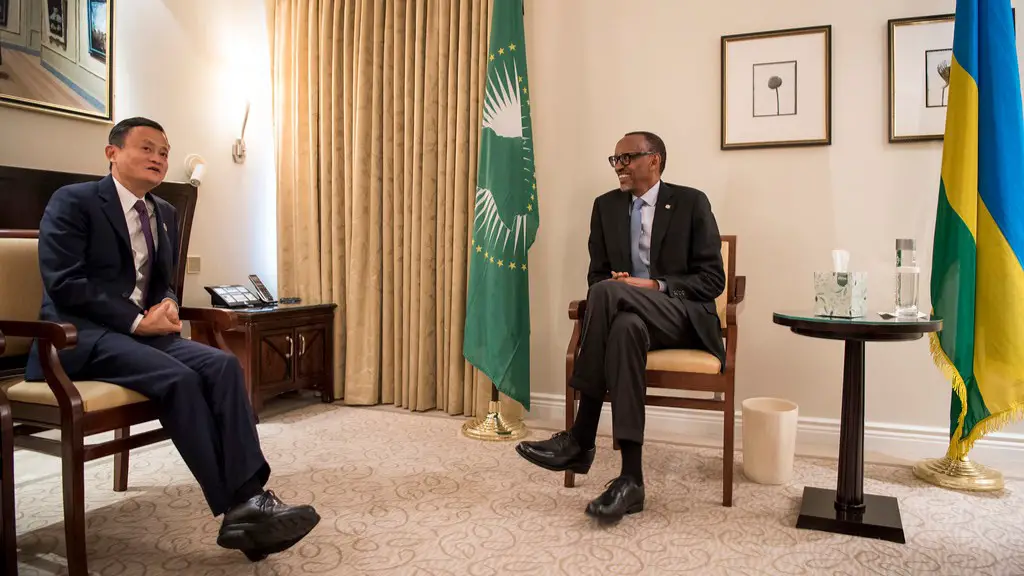

Ma’s departure from the public scene comes after Beijing’s crackdown on the technology sector, which has seen a number of high-profile arrests and regulatory actions targeting some of China’s biggest tech companies. Ma has been critical of the government’s actions, saying they will stifle innovation. Alibaba, which is China’s biggest e-commerce company, has also been caught up in the crackdown, with several of its employees detained. Ma has not been seen in public since October 24, when he gave a speech critical of the Chinese government’s regulatory regime.

The Alibaba Group is a Chinese multinational technology conglomerate specializing in e-commerce, retail, Internet, and technology services. The company was founded in 1999 by Jack Ma, and is one of the world’s largest and most valuable technology companies, with a market cap of over US$475 billion as of January 2020. The group’s major business interests include e-commerce, retail, Internet, and technology services. Alibaba is one of the world’s largest online and mobile commerce companies, and one of the world’s largest Internet companies. The company operates in over 200 countries and regions, and has over 700 million active users. Alibaba has been one of the world’s leading e-commerce players, and has been one of the fastest-growing companies in the world.

Who owns Baba stock

Alibaba Group Holding Ltd is a Chinese multinational conglomerate holding company specializing in e-commerce, retail, Internet, and technology. Founded in 1999 by Jack Ma, Alibaba Group has grown to become one of the world’s largest companies, with a market cap of over $500 billion as of 2019. The company operates in over 200 countries and regions, and its core businesses include online and mobile commerce, cloud computing, and artificial intelligence.

Alibaba Group’s largest shareholders are PRIMECAP Management Co, Dodge & Cox, HSBC Global Asset Management (UK), and Goldman Sachs International. Together, these four investors own over 50% of the company’s stock.

According to analysts, the stock price of Alibaba Group Holding Ltd is forecast to rise significantly in the next 12 months. The median target price is 14399, which represents a 3976% increase from the current price of 10303. There is a wide range of estimates, with the high estimate being 21725 and the low estimate being 9709. However, the majority of analysts believe that the stock price will continue to rise in the next year.

What will BABA stock price be in 2025?

Alibaba stock has been on a steady rise in recent years and is expected to continue to rise in the coming years. Some analysts predict that the stock will hit the $300 mark by 2025, $350 by 2027 and $410 by 2030. If these predictions are accurate, Alibaba will be a very profitable investment in the coming years.

Alibaba Group Holding Limited (BABA) may be undervalued according to valuation metrics. Its Value Score of B indicates it would be a good pick for value investors. The financial health and growth prospects of BABA demonstrate its potential to outperform the market. It currently has a Growth Score of C.

How much did Jack Ma sell Alibaba for

A new generation of executives is now responsible for the day-to-day operations of Ma’s tech interests in China. In August, Japan’s Softbank sold its 237% stake in Alibaba to 146%, making $34bn. This historic move signals a change in the leadership of Ma’s tech empire.

Alibaba is a Chinese e-commerce company that makes its money through a variety of businesses, including e-commerce, logistics, cloud, digital media, and subscription software. While Alibaba reports its businesses in four different segments, we have reworked its structure into five segments that better capture the company’s overall operations.

What is the monthly income of Jack Ma?

Jack Ma is a Chinese billionaire and business magnate. He is the founder and executive chairman of Alibaba Group, a multinational technology conglomerate. As of March 2019, Ma is the second richest person in China with a net worth of $38.2 billion, behind only Zhang Yiming. He is also the richest person in Asia.

While Amazon is the current leader in the US and abroad, Alibaba’s expansion is a threat that will only continue to grow The winner may depend on who can be the first and most effective at penetrating new foreign markets. For Amazon, this means expanding its footprint in China and other countries where Alibaba is strong. For Alibaba, this may mean expanding its e-commerce offerings to better compete with Amazon’s Prime service.

Conclusion

According to the latest filings, Jack Ma owns approximately 6.4% of Alibaba Group.

After looking into the matter, it appears that Jack Ma owns around 6.6% of Alibaba stock, which is worth a large sum of money. Although there are some that say he may own more, this is the estimated amount based on public information. Ma is clearly a shrewd businessman and his early investment into Alibaba has certainly paid off.