Background Information

GameStop is a U.S.-based retailer of video game products and other consumer electronics. The company employs more than 32,000 people and owns over 7,000 stores across the globe. GameStop’s stock had been trading at $19 per share in January 2021 and gradually increased to $48 per share within the same month. The boost in GameStop’s stock prices was mainly due to individual traders banding together on Reddit and other social media platforms to purchase (and hold) GameStop’s stock shares. This drove up the stock price, and these Reddit traders were able to make a profit from their purchases.

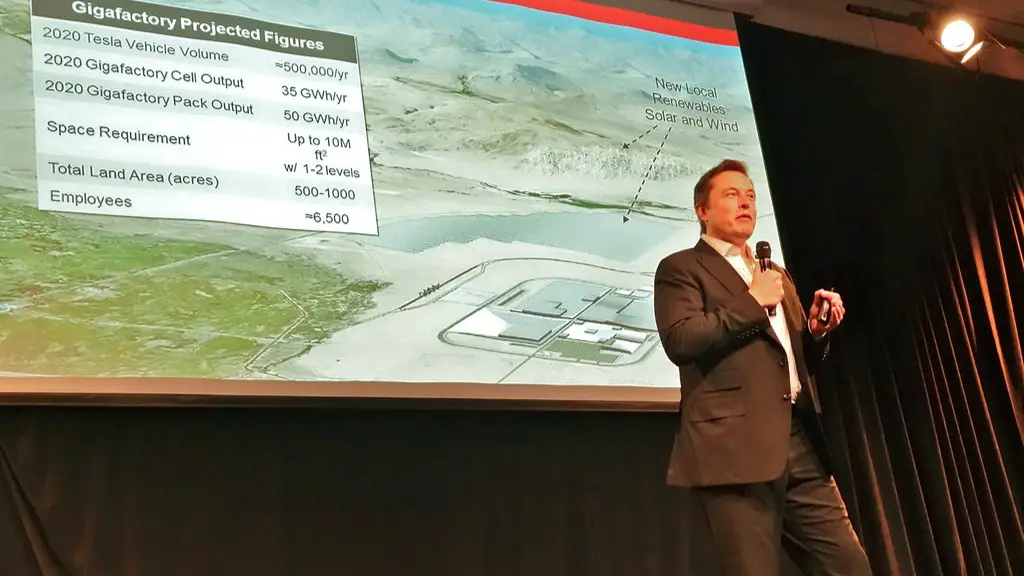

Elon Musk, the founder of Tesla and SpaceX and one of the world’s wealthiest individuals, took notice of the GameStop stock surge and tweeted his support for the effort. He added fuel to a fire that was already burning, and this drove the stock price to skyrocket even higher. Musk’s support of GameStop created speculation that he would purchase the gaming retailer, leading many to ask whether Elon Musk is going to buy GameStop.

Relevance to Elon Musk

It is not impossible for Elon Musk to purchase GameStop, as he has the necessary assets to do so and he has been known to make large investments in the past. For instance, in 2015, Musk purchased SolarCity, a solar panel company, with funds from Tesla and his own pocket. Similarly, in 2016 he invested over $500 million of his own money in the construction of a tunnel – The Boring Company – that creates underground transportation networks.

However, Elon Musk’s investments have not always been successful. For example, SolarCity was declared bankrupt two years after Musk bought it and the Boring Company has yet to be profitable.

Musk could explore this opportunity further in the near future, but he is not known to make decisions based on the hype alone; rather, he tends to use logical decision-making when it comes to his investments. Furthermore, even if Musk were to buy GameStop, he would not be able to turn the company into a profitable venture over-night as it faces immense competition from other gaming retailers.

Potential Benefits To GameStop

It would certainly benefit GameStop if it was purchased by Musk. For starters, Elon Musk is well known for pushing boundaries and making bold, if not risky moves. He could potentially turn GameStop into an incredibly lucrative venture if he could leverage his high profile status and investor intelligence.

Furthermore, if Musk were to purchase GameStop, he could introduce some of his own ideas to the company. He could implement his vision of customer service, which is focused on using technology to automate customer interactions and offer incredible value to its customers. Moreover, with the money at Musk’s disposal, he could finance the rapid expansion of GameStop’s stores in the U.S. and beyond.

Experts’ Perspectives

Several experts have weighed in on the speculation that Musk may purchase GameStop. According to stock market experts, Musk does not usually make investments based on hype, so it is unlikely that he would actually buy the company. The stock market is unpredictable, and purchasing GameStop would be a high-risk move for Musk as it could cause a massive financial backlash if the stock prices plumate once the current surge of interest dies down.

Additionally, analysts are of the opinion that even if Musk were to purchase GameStop, the company still faces a number of challenges. It would be incredibly difficult to turn the company into a profitable venture as it competes with several established gaming retailers, such as Walmart and Best Buy.

Gig Capital’s Investment

Gig Capital (Gig) announced its intention to invest in GameStop in January 2021, further raising the possibility that Elon Musk may make the purchase. Gig Capital is a global investment group founded by former billion-dollar PE Fund Activism investor Gigi Levy-Weiss; it has already invested in a number of companies, including Burger King and Activision Blizzard.

The company announced it would purchase up to $500 million of GameStop’s shares over the next twelve months, in order to increase the value of the shares and make a handsome profit. However, this does not mean that Elon Musk is planning to buy GameStop as Gig Capital made its announcement before Musk expressed his support for the Reddit traders.

Analysis and Insights

The rise of GameStop’s stock prices created a lot of speculation that Elon Musk might buy the company. Although it is possible, Musk is unlikely to make this move as he usually makes informed and logical investments. Furthermore, even if Musk was to make this purchase, GameStop still faces intense competition from other gaming retailers and it would take a huge amount of financial resources for Musk to make GameStop a viable and profitable venture.

Other Areas of Interest

GameStop’s Challenges

GameStop’s success still faces many challenges, regardless of whether it is purchased by Musk. The company faces immense competition, primarily from online gaming stores such as Microsoft’s Xbox marketplace and Amazon. These stores typically offer games at cheaper prices, removing much of the incentive for customers to purchase physical copies of games. Additionally, the increase in digital downloads of games have caused a decrease in sales of physical copies, which is majorly affecting GameStop’s profitability.

Moreover, GameStop’s expansion plans are limited by its financial resources. The company has limited access to capital, as it has struggled to effectively restructure its debt and increase profits. This leaves GameStop in a very precarious position, and it is uncertain whether the company can turn its fortunes around without major investments.

Options For GameStop

GameStop has several options available to it. For instance, the company could seek additional investment from outside investors or venture capitalists. This would provide the company with the boost it needs to restructure its business model and pay off its debts.

GameStop can also explore the possibility of an acquisition offer from Elon Musk, as well as any other interested buyers. This could potentially provide the funding and resources for the company to explore new avenues of business and invest in alternative markets, such as digital gaming and an online store.

The company can also pursue partnerships with other companies in the gaming industry. This could provide GameStop with the necessary capital to expand its operations and reach a larger customer base. Additionally, partnerships could help GameStop become a more competitive player in the industry, as well as provide access to new technologies that can be used to improve customer experience.

Heavy Trading Volume and Short Selling

The surge in GameStop’s stock was largely due to the heavy trading volume and short selling, which caused the price of the stock to skyrocket. This phenomenon has been widely discussed in the media, and experts have offered their insight into the matter.

The increased trading volume and subsequent increase in GameStop’s stock prices are a result of Reddit traders capitalizing on an opportunity to make a profit. The traders realized that certain stocks were heavily shorted by institutional investors and took advantage of this by purchasing large amounts of the stock and then selling it for a profit when the price increased.

However, it is still uncertain what will happen to GameStop’s stock prices once the surge of interest dies down. Experts have warned that the stock may crash if short selling continues, as the short positions will start to unwind and the stock prices may plummet.

Regulations and Laws Regarding Trading

The U.S. Securities and Exchange Commission (SEC) issued a statement in response to the speculation surrounding GameStop’s stock price surge. The SEC noted that it has been monitoring the situation and that it will take appropriate action if necessary.

The statement also addressed some of the concerns surrounding regulations and laws regarding trading. The SEC stated that trading in the stock market is subject to certain laws and regulations and that investors and traders must adhere to these laws and regulations in order to ensure the integrity of the markets. Furthermore, the SEC reiterated that traders must be aware of the risks associated with trading and should conduct due diligence before investing in a stock.