As one of the most successful entrepreneurs of the 21st century, Elon Musk has gained a vast amount of success, wealth, and notoriety. Musks involvement in numerous innovative and creative ventures have earned him a vast fortune, with interests in PayPal, Tesla, and SpaceX, among others, and a range of business holdings around the world. Elon Musk has made a name for himself through the success of SpaceX and his company’s successful mission to the International Space Station. His popularity extends off the planet and into the financial sphere, where he has invested in a variety of coins. While some of his investments may appear confusing, this article will examine Elon Musk’s crypto investments, their impact on the market, and how it affects his overall investment portfolio.

One of the first coins Musk reportedly invested in is Bitcoin (BTC). Initially, he was quite open about his intention to invest in the leading digital currency, tweeting about it in January 2021. Later in the year, he made waves in the crypto world when he took Tesla public and announced the company’s investment in Bitcoin. Musk has remained a participant in the cryptomarket, regularly tweeting and highlighting various cryptocurrencies. Since his initial foray into the cryptocurrency space, Musk has shown an interest and enthusiasm for decentralized currencies like Bitcoin and Ethereum (ETH).

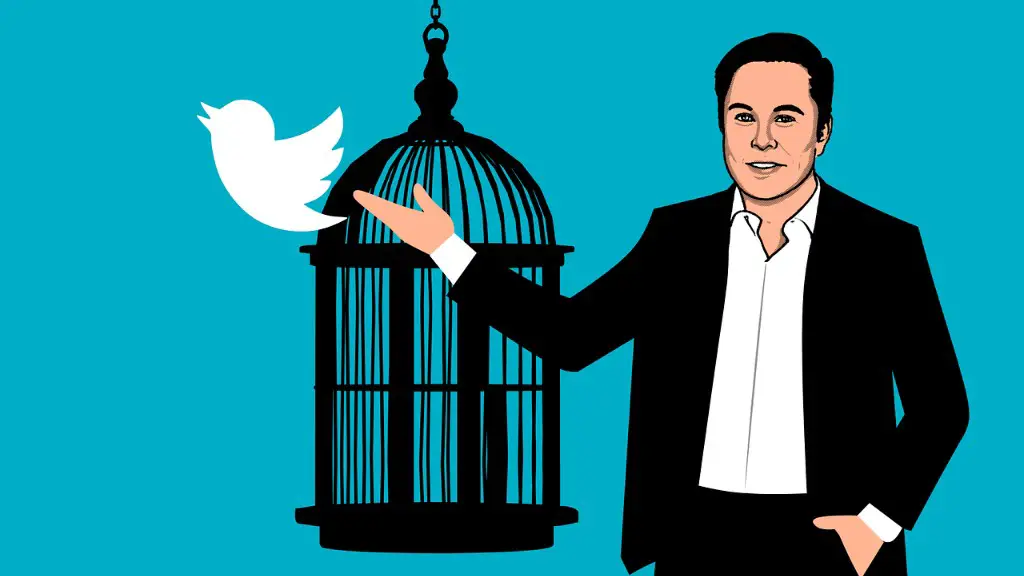

The second coin Musk has invested in is Dogecoin (DOGE). Musk’s involvement in Dogecoin has been well-documented, starting with cryptic tweets in December 2020. His tweets had a significant effect on the coin, causing it to rally and increase in value. Since then, Musk has appeared regularly on social media discussing the meme coin, with much of the discussion about its potential for use within SpaceX’s projects. Musk has remained optimistic about the digital currency, believing that its value will continue to rise over time. As a result of his support, Dogecoin has been recognized as a legitimate digital currency, traded on various cryptocurrency exchanges.

Musk has also invested in Chinese digital currency, CDY, or Chinese Digital Yuan. This is a digital currency developed by China to move away from a reliance on the US dollar. Musk has been vocal about its impact on the global economy and believes it will have far-reaching benefits. He recently tweeted that the transition to a digital yuan has the potential to be a “significant de-dollarization” event. Musk’s investment in CDY shows his recognition of the potential of crypto to advance global economic trends abroad.

Finally, Musk’s most recent foray into the cryptocurrency industry is his investment in Chia (XCH). Chia is a decentralized digital currency created to compete with Bitcoin. It utilizes a proof-of-space and time algorithm rather than the energy-intensive proof-of-work algorithm used by other currencies. Musk believes that this algorithm has the potential to increase the efficiency of the coin and reduce its carbon footprint. His investment in Chia reflects his support of green initiatives, while also highlighting his confidence in the potential of decentralized currencies.

Impact of Musk’s Involvement with Cryptocurrency

The impact of Musk’s involvement with cryptocurrency has been significant. His well-publicized investments in Bitcoin, Dogecoin, CDY, and Chia have been instrumental in bringing digital currencies into mainstream consciousness. His tweets and commentary have increased the visibility and appeal of cryptocurrencies, which has resulted in increased investment and speculation in the market. Likewise, his willingness to be involved with such projects has inspired others to do the same and helped to create a general enthusiasm for the technology.

Musk has also had a tangible impact on the market. His investment in Bitcoin has helped to increase the price, as well as the overall value of the leading digital currency. Similarly, his involvement with Dogecoin and other altcoins like Chia and CDY has resulted in a surge in their respective values. Through his actions, he has been able to increase the value of cryptocurrencies as a whole, while simultaneously helping to popularize the technology.

Musk has also used his influence to bring attention to important topics like sustainable energy and the environment. His investment in green initiatives like Chia is a testament to his commitment to reducing the carbon footprint of the cryptocurrency market. His focus on sustainability has helped to legitimize projects like Chia and encourage other investors to focus on green solutions. Through his investments and efforts to reduce the environmental impact of cryptocurrency, Musk has helped to make the industry more sustainable and one that people, businesses, and governments trust more.

Risks of Investing in Cryptocurrency

Musk’s investment in cryptocurrency has been widely discussed, but it has also raised some concerns. Many people point to the volatility of the cryptocurrency market, which can quickly cause huge losses for investors who are not careful. As a result, investors should be aware of the risks before investing, as the market can be unpredictable and the value of a given coin can plunge in a matter of seconds.

In addition, investors should be aware of the potential for fraud and manipulation. The cryptocurrency market is largely unregulated, which makes it vulnerable to manipulation and other fraudulent activity. As such, investors should be sure to perform due diligence before investing, as well as research the company or project they are investing in carefully.

Finally, it is important to remember that cryptocurrency is still an emerging industry, with many unknowns and potential pitfalls. Investors should never invest more than they can afford to lose, as the market can be unpredictable. While Elon Musk has made numerous investments in digital currencies, that has not shielded him from market volatility or the possibility of losses.

Regulation of the Cryptocurrency Market

The emergence of cryptocurrency has led to questions about how to regulate this new technology. Regulatory bodies around the world are scrambling to figure out how to govern the cryptocurrency market. This is a major challenge, as cryptocurrencies are decentralized and not controlled by one governing body. As such, the regulation of the cryptocurrency market must be done on an international level in order to effectively protect investors and reduce the risk of fraud and manipulation.

In the United States, regulatory bodies like the Securities and Exchange Commission (SEC) are attempting to create a set of regulations that will protect investors while also allowing innovation. The SEC has stated that they believe cryptocurrencies can have legitimate uses and serve as a legitimate asset class. As a result, they have proposed rules that would allow investors to trade cryptocurrencies with certain restrictions in place.

In addition to the United States, the European Union has been active in regulating the cryptocurrency market, releasing the Fifth Anti-Money Laundering Directive (5AMLD) in February 2020. The directive requires exchanges to register with the appropriate national regulator and to track their customers’ data. By introducing this legislation, the EU is attempting to create an environment in which cryptocurrencies can be traded safely and securely.

Finally, countries like Japan, South Korea, and China are also attempting to create regulations for the cryptocurrency market. Japan, for example, has created a set of guidelines for exchanges and other participants in the crypto market. Similarly, South Korea has also implemented regulations in order to protect investors, ensure transparency, and reduce the risk of fraud. These countries recognize the potential of cryptocurrency and are actively working to protect investors while allowing innovation to occur.

Adoption and Use of Cryptocurrency

The increasing acceptance of cryptocurrency has been a major factor in its growth and success. Major corporations such as Tesla, Microsoft, and JP Morgan Chase have begun to explore and even embrace the technology, and many smaller businesses have also started to accept digital currencies as a form of payment. This increased adoption has had a major impact on the value of digital currencies, as investors and companies see the potential of the technology and the market.

Not only has adoption of digital currencies increased, but so has the use and integration of the technology. Companies like Coinbase and Binance are offering increasingly sophisticated services and products to make investing in crypto easier. In addition, more merchants are beginning to accept crypto as a viable form of payment, promoting the use of digital currencies in everyday transactions. As a result, more people are beginning to recognize the potential of digital currencies and are using them to manage their finances.

The increasing mainstream acceptance of digital currencies has been a major catalyst for their success. This has resulted in more investment in the technology, which has helped to drive up the value of coins. As these trends continue, cryptocurrencies are becoming a mainstream asset class, with more people investing and using them as part of their financial portfolios.

Future of Cryptocurrency

The future of cryptocurrency is uncertain, but the growth of the industry so far indicates a bright future. As more people and companies embrace the technology, the value of digital currencies is likely to continue to rise. As digital currencies become increasingly integrated into the global economy, their use and adoption will become more widespread. This could potentially revolutionize the way people and businesses conduct transactions and manage their finances.

In addition, as more regulation is put in place, this could help create a more secure and safe environment for investors. Regulatory bodies around the world are gradually coming to terms with the technology, which could help protect investors and ensure the stability of the market. As more countries come on board, it is likely that the cryptocurrency market will become more secure and legitimate.

Finally, the increasing popularity of digital currencies could be a catalyst for the development of new technologies, services, and products related to cryptocurrency. Companies such as Coinbase, Binance, and others are already developing and launching new services, and it is likely that many more will enter the market as the industry continues to develop. This could open up new opportunities for investors, businesses, and even everyday users.