The Cyclical Realm of Market Investing: Where Does Elon Musk Invest

Elon Musk is one of the most iconic entrepreneurs of our time and is no stranger to investing wisely. Elon Musk is an investor in the world of technology, not only having bought a stake in Tesla Motors, but has also invested in other start-ups and businesses. From his investments in the renewable energy space to the world of digital payments, Elon Musk has certainly made an impact on the market.

What can we learn from Elon Musk’s investment decisions? How has he been able to generate returns using market-based investments? At the same time, what other lessons can investors learn from his decisions?

In many ways, Elon Musk’s investments are cyclical in nature. This means that his investment decisions will often be based on the performance of markets and their future direction. When markets are performing well, his investment portfolio will be more heavily weighted towards aggressive stocks or finance-based investments. By contrast, if the markets are in a downturn, his portfolio will focus on more defensive securities, such as bonds or cash. In this way, Elon Musk is able to capitalize on both the changing market conditions and his own investment decisions.

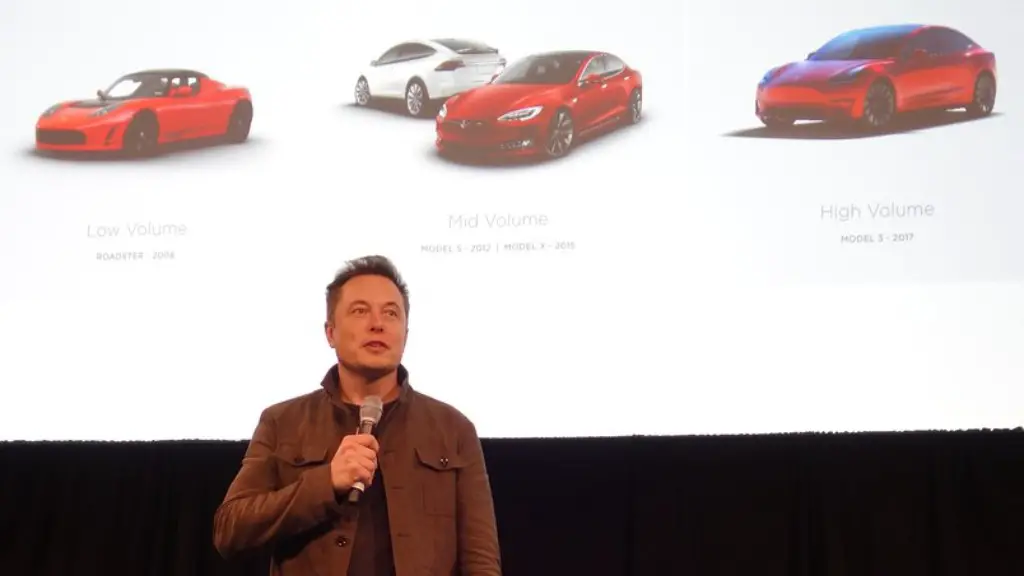

In recent years, Elon Musk has increasingly ventured into the realm of venture capital. His investments have ranged from start-ups in energy, transportation, and other areas to big tech companies such as Hyperloop and SpaceX. In many cases, his investments involve financial risk, but can also provide long-term returns. For example, Tesla Motors has seen huge increases in its stock from its initial public offering in 2010.

In addition to his venture capital investments, Elon Musk has also invested in a wide variety of other businesses. He has invested in a number of start-ups, such as Hyperloop and startup incubators such as Y Combinator. He has also invested heavily in both digital payment solutions and renewable energy solutions. These investments have enabled Musk to position himself as a leader in the fields of technology and innovation.

Furthermore, it’s important to point out that Elon Musk also pays attention to the macroeconomic environment when determining where to invest. He knows that certain market sectors will be more sensitive to certain conditions. For instance, he has historically done well by investing in gold whenever the U.S. dollar weakens. Elon Musk also pays attention to political developments, such as trade wars between countries, that have an outsized effect on certain investments.

An additional insight into Elon Musk’s investment strategy is his preference for long-term assets. The inventor of the Tesla and Space X has never been interested in short-term gains and is willing to remain committed if his investments pay off in the distant future. His faith in long-term investments is a differentiating factor between traditional investors, who are often willing to cash out if the short-term returns are promising.

The Benefit of Being an Early Investor

One of the benefits of being an early investor is the possibility of compounded growth over time. Despite temporary market fluctuations, Musk’s investments have seen strong growth in the long run. This is not just due to his excellent returns, but also to the fact that he is often among the first to invest in technologies and initiatives, and often benefits from the scale that comes with investing early.

For example, Elon Musk was among the first to invest in the development of renewable energy solutions. This has resulted in Tesla Motors becoming one of the leading companies in the automobile and energy sector and has made him personally very wealthy.

Elon Musk has also been involved in the development of satellite technologies and space launches, investing heavily in his own business venture “SpaceX”. His investments in venture capital projects, such as Hyperloop, as well as other big tech companies, has resulted in huge returns for him and several companies associated with him. All of these investments were made possible through his being an early investor.

The Benefit in Diversifying Investments

Another key lesson to consider from Elon Musk’s investment strategy is his tendency to diversify. By diversifying his portfolio across multiple industries, investments, and regions, Elon Musk is able to manage and limit risk. Therefore, while some of his investments may suffer losses, he is able to diversify and spread out the risk.

For instance, when investing in the stock market, Elon Musk is known to diversify his portfolio across sectors, industries, and even countries. This means that if one sector or industry underperforms, he will have other investments performing well. Similarly, when investing in venture capital, Elon Musk is known to spread his risk across multiple investments and thus minimize the potential losses he could incur.

Profit-Making versus Having Belief in the Company’s Potential

Another key lesson to understand when studying Elon Musk’s investment decisions is the balance between profit-making and believing in the potential of a company. It is no secret that Musk is an entrepreneur and innovator at heart. Therefore, when investing in a venture or a company, he tends to evaluate its potential and weigh that against its profit potential. Often, when these two factors are balanced correctly, a successful investment follows.

For example, Elon Musk has invested massively in Tesla Motors for the past 8 years, despite there being no guarantee of success. This was due to his belief in the potential of the company rather than its immediate commercial prospects. Ultimately, his faith in the company’s potential has been rewarded with huge returns.

Know When to Pull Out of an Investment

Finally, it is also important to remember that Elon Musk’s investments are not always profitable. As an investor, it is important to know when to pull out of an investment if it is not performing as expected. Knowing when to sell an investment, particularly if there is still potential for long-term growth, is a difficult but important decision.

Elon Musk is one of the most successful investors in the world. His investments are often guided by his strong understanding of the market and his belief in the potential of the companies he invests in. By following this simple strategy, investors can be sure to make sound investments that are likely to offer good returns in the long run.

The Benefit of Thinking Outside the Box

Elon Musk’s investment strategy often involves thinking outside the box and taking risks. One example of this is his investment in Hyperloop, a revolutionary high-speed transportation technology that is still in its early stages of development. The development of such a technology is risky, but the potential returns could be huge.

In addition to the potential of earning huge profits, Musk invests in projects such as Hyperloop because of their potential to change the world. This demonstrates Musk’s true belief in the value of innovation and his willingness to take risks. By investing in such projects, his investment portfolio stands a chance to reap the rewards of being on the cutting edge.

Musk also often invests in new technologies that have the potential to revolutionize existing markets. For example, he invested heavily in the cryptocurrency space, despite the inherent risks involved. His stance on digital payment solutions was not always popular, but his investment in Bitcoin has now been rewarded with huge returns.

Elon Musk’s Investment Philosophy: A Summary

In summary, Elon Musk’s investment philosophy is a combination of cyclical and long-term investing strategies. He often invests in venture capital projects and actively looks out for market trends. He is also an early investor in transformative technologies, such as the Tesla electric car, and renewable energy solutions. Furthermore, he diversifies his portfolio, believing that this will minimize risk and create better returns in the long run.

All in all, when formulating an investment decision, investors should consider Elon Musk’s investment philosophy and apply it to their own financial decisions. By understanding the risk and reward of various investments, one can weigh the two against one’s risk tolerance and target returns.