As of March 2019, Jack Ma holds 6.42% of Alibaba Group’s stock, making him the company’s largest individual shareholder. Alibaba Group is a holding company with a diverse set of businesses, including e-commerce, retail, digital media and entertainment, technology, and artificial intelligence. Ma’s stake in Alibaba is worth an estimated $40.8 billion.

As of March 2018, Jack Ma owned 9.3% of Alibaba Group.

Jack Ma’s ownership stake in Alibaba has decreased from 62% to 45% over the past two years. While this may be due to a variety of factors, it’s likely that Ma has been selling off his shares in the company. This could be for personal reasons (e.g. to diversify his portfolio) or because he’s planning to step down from his role at Alibaba. Either way, it’s clear that Ma’s stake in the company is slowly but surely decreasing.

Alibaba is a Chinese e-commerce company that is headquartered in Hangzhou, Zhejiang province. It is the world’s largest online and mobile commerce company, measured by gross merchandise volume. The company was founded in 1999 by Jack Ma and 17 other co-founders.

Japan’s SoftBank is believed to be BABA’s largest shareholder, owning around 24% of the company. Its stake used to be larger, and there are rumors that it may sell even more in the near future.

Ma still owned a 89% stake in the company at the time Chinese regulators said they were investigating Alibaba Group Holdings Ltd over “suspected monopolistic practices” And on Dec 28, China told Ant Group to limit its ambitions and focus on payment services instead of insurance or wealth management.

This is a difficult time for Alibaba and Ma. They are under a lot of pressure from the Chinese government. They need to focus on their core business and make sure they are compliant with regulations.

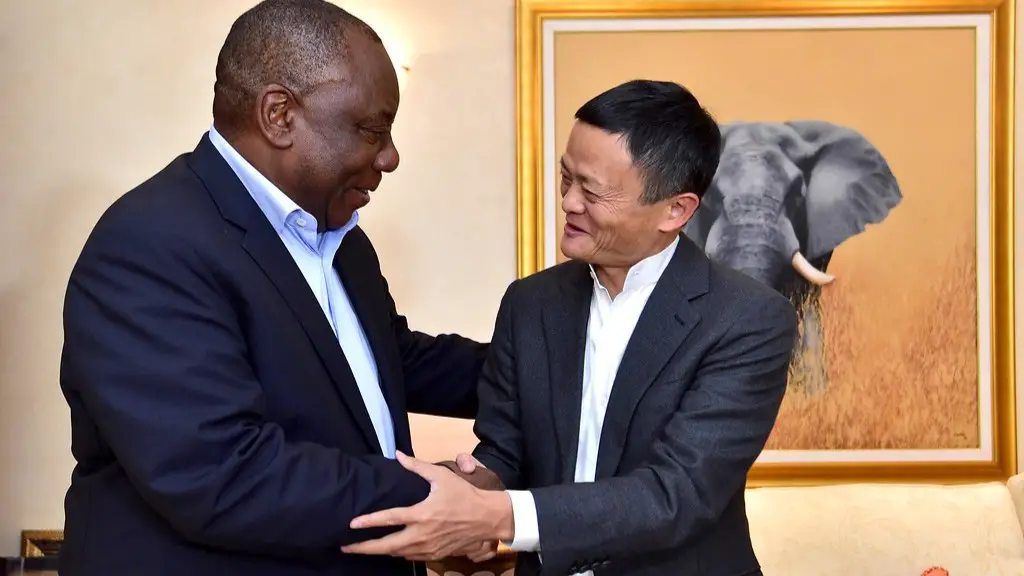

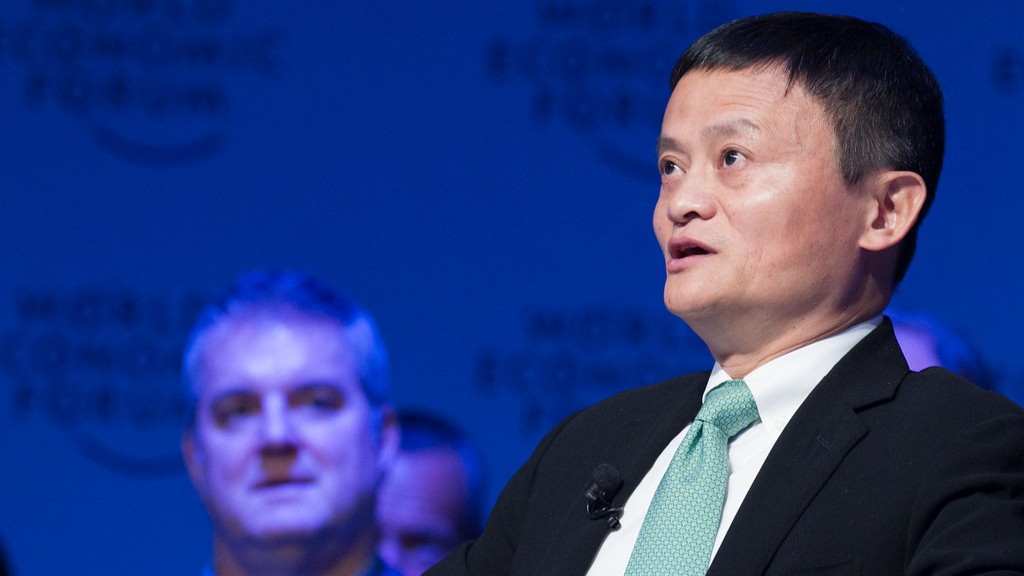

Jack Ma is a Chinese business magnate and philanthropist. He is the co-founder and executive chairman of Alibaba Group, a multinational technology conglomerate. In 2015, he was ranked as the 30th most powerful person in the world by Forbes. He has also been referred to as China’s richest man.

Ma was born in Hangzhou, China. He began his career as an English teacher, and later worked as a tour guide. He started his own business in 1988, and in 1999 he founded Alibaba Group. Alibaba Group is a holding company with nine major subsidiaries: Alibaba.com, Taobao, Tmall, Juhuasuan, 1688.com, AliExpress, Alibaba Cloud Computing, Cainiao Network, and Ant Financial. Alibaba Group’s mission is to “make it easy to do business anywhere”.

Ma is a strong advocate of the power of the Internet and has been credited with helping to create China’s e-commerce industry. He is also a passionate supporter of education, and has set up a number of schools and scholarships in China.

Does Warren Buffett hold Alibaba?

It’s no surprise that Daily Journal Corp, which is run by Charlie Munger, has increased its stake in Alibaba. After all, Alibaba is one of the hottest companies in the world right now, and Munger is known for his investing prowess.

What is interesting, however, is that Daily Journal has nearly doubled its stake in Alibaba. This shows that Munger is confident in Alibaba’s long-term prospects and is willing to bet big on the company.

It will be interesting to see how Alibaba performs in the coming years. With Munger’s backing, it seems like the sky is the limit for this e-commerce giant.

Bill Gates is the world’s wealthiest person, and his natural stock pick is Microsoft (NASDAQ:MSFT). Gates co-founded Microsoft with Paul Allen in 1975, and he still owns almost 103 million shares of the company, which are worth $154 billion. Microsoft is a giant tech company that is widely respected and admired, and it is clear that Gates has a lot of faith in its future. Gates’ investment in Microsoft is a wise one, and it is likely to continue to pay off handsomely for him in the years to come.

Which is bigger Amazon or Alibaba?

There are two major ecommerce platforms in the world, Amazon and Alibaba. While their market shares may be different, they each dominate their respective countries. Amazon started in the US and now controls 39% of all US ecommerce sales. Alibaba started in China and now controls 582% of all retail ecommerce sales in China.

2 positions in the Top 50 Global Retailers list, respectively, while China’s Alibaba has dropped out of the top 10 for the first time.

According to the list compiled by industryTracker, Walmart is the world’s largest retailer with sales of $513.4 billion in 2019, followed by Amazon with sales of $341.7 billion.

Alibaba, which is the largest online retailer in China, was ranked No. 3 in the world in 2018 with sales of $309.8 billion but has dropped to No. 12 in 2019 with sales of $205.2 billion.

Some of the other notable retailers in the top 50 include Costco (No. 4), The Home Depot (No. 5), JD.com (No. 6), Ikea (No. 7), Macy’s (No. 8), CVS Health (No. 9) and Target (No. 10).

Who has more money Amazon or Alibaba

Some analysts expect Amazon to generate more than three times as much revenue as Alibaba this year. Amazon’s market cap of $17 trillion dwarf’s Alibaba’s market cap of approximately $333 billion. This is a huge difference and it’s expected that Amazon will continue to be the leader in terms of revenue.

There are a few things to keep in mind when writing a note. First, make sure to write in a clear and concise manner. Second, try to be as concise as possible while still conveying all the information you need to. Finally, be sure to proofread your note before sending it off.

Who invested in Baba stock?

Alibaba Group Holding Ltd is a Chinese multinational conglomerate holding company specializing in e-commerce, retail, Internet, and technology. The company was founded in 1999 by Jack Ma and Joe Tsai and is headquartered in Hangzhou, China. As of March 2019, Alibaba Group has a market capitalization of $487.8 billion. The company operates in over 190 countries and regions and employs over 100,000 people.

The following are the top 10 owners of Alibaba Group Holdings Ltd stock, as of March 2019:

1. PRIMECAP Management Co – 0.66%

2. Dodge & Cox – 0.54%

3. HSBC Global Asset Management (UK) – 0.51%

4. Goldman Sachs International – 0.46%

5. BlackRock Investment Management (UK) – 0.34%

6. BNP Paribas Asset Management – 0.33%

7. Capital Research & Management Co – 0.33%

8. Norges Bank Investment Management – 0.32%

9. Vanguard Group, Inc – 0.28%

10. Fidelity Management & Research Co – 0.27%

Alibaba does not currently pay a dividend to shareholders. This may be because the company is reinvesting its profits back into the business, or because the board of directors has not decided to pay a dividend at this time. shareholders who are looking for income from their investment may want to look elsewhere.

Who invested 20 million Alibaba

Masayoshi Son is a Japanese business magnate and the founder and current chief executive officer of SoftBank Group. He is credited with turning SoftBank into one of the world’s leading technology investors.

Mr. Son’s $20 million investment in Alibaba in 2000 is widely considered to be one of the most successful venture capital investments of all time. When Alibaba went public in 2014, Softbank’s shares were worth a staggering $60 billion.

Mr. Son is a well-known philanthropist and has donated billions of dollars to various causes over the years. In 2020, he pledged $1 billion to assist with relief efforts in the wake of the COVID-19 pandemic.

As a publisher, you will earn a commission rate of 7% of the transaction value (excluding any insurance fees, delivery fees or other relevant fees and expenses) of each Qualifying Purchase. To be eligible for the program, all publishers must join our program and agree to our terms and conditions. Thank you for your interest in our program!

Who is richest man in China?

Zhong Shanshan is currently the richest Chinese billionaire and is ranked as the eighth wealthiest man in the world as of March 11, 2022. He is the founder, chairman and CEO of Nongfu Spring, the largest bottled water company in China. He is also the chairman of Want Want China, the largest producer of rice crackers in China. Zhong has a net worth of $62.7 billion.

Warren Buffett is one of the most successful investors of all time. Over his career, he has amassed a massive fortune. His investment philosophy is to buy great companies at reasonable prices and hold them for the long term.

Buffett’s portfolio is heavily diversified. He owns shares in companies from a wide range of industries. His top holdings by market value are Apple, Bank of America, Chevron, and Coca-Cola. These are all large, well-established companies with strong brand equity. They trade at reasonable valuations and offer good dividend yields. Buffett has been a shareholder in all of these companies for many years.

Conclusion

Jack Ma owns approximately 18.5% of Alibaba stock.

As of March 2018, Jack Ma held a little over 50% of Alibaba stock. While this is subject to change, it gives Ma significant control over the company. This control allows him to make decisions that he thinks are best for Alibaba, without having to worry about dissenting opinions from other shareholders.