When it comes to business, few names are as recognizable as Elo Musk. The South African entrepreneur and investor, who recently sold Tesla to a Chinese government-owned company at a $75 billion valuation, has garnered tremendous wealth through a number of investments and other ventures. He’s also been vocal about his support for both clean energy and space exploration. But what stocks does Musk own, and how can you benefit from his expertise? In this article, we’ll take a look at some of the top stocks in Musk’s portfolio, and where investors may want to put their money.

The Companies Elom Musk Has Invested In

Musk’s portfolio contains dozens of companies, but here are some of the major ones:

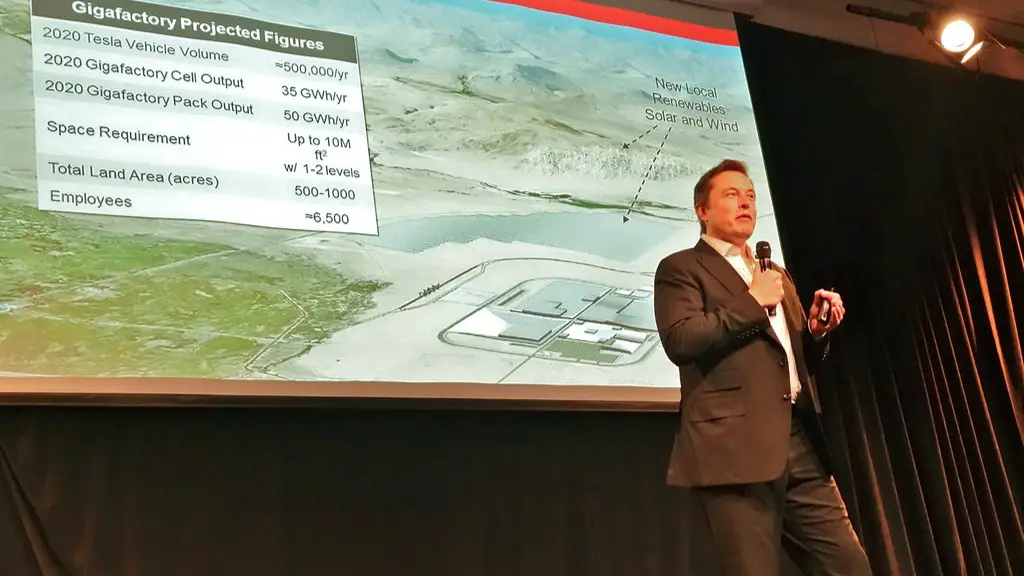

- Tesla: A leading electric car manufacturer, Tesla has a current market capitalization of over $275 billion—making it one of the most valuable companies in the world. Musk has an estimated $13.5 billion stake in the company, primarily through stock options.

- SolarCity: SolarCity is an energy services company that provides residential and commercial solar power systems.

- SpaceX: SpaceX is one of the world’s leading aerospace companies. It develops, manufactures and launches advanced rockets and spacecraft.

- DeepMind Technologies: DeepMind Technologies is a leading artificial intelligence (AI) research company that focuses on creating smarter machines.

Musk has also made investments in PayPal, Hyperloop, and other tech companies.

Benefits of Investing in Musk-owned Companies

There are a number of potential benefits to investing in companies owned by Elom Musk. For starters, since Musk has a vested interest in the company, he is likely to be actively involved in its management and growth. He is also likely to be more inclined to take risks that other investors may not be comfortable with, which could lead to higher returns in the long run.

Moreover, investing in Musk-owned companies may provide investors access to new technologies and ideas before they become widely known and adopted. For instance, Tesla and SolarCity are both leading innovators in the clean energy space. Investing in these companies can be a good way to stay ahead of the curve and benefit from their potentially lucrative technologies.

Risks of Investing in Musk-owned Companies

As with any investment, there are potential risks involved when investing in companies owned by Elon Musk. For instance, since he is often an active participant in the companies’ management, he may not always make the most sound decisions. It is also important to note that most of Musk’s companies are still relatively young and may experience growing pains, especially given the intense competition in the tech and renewable energy sectors. Finally, Musk’s investments are usually highly volatile, so it is important to have realistic expectations.

How to Invest in Musk-Owned Companies

Investing in companies owned by Elon Musk is relatively easy. The easiest way is to invest in the stocks of the companies directly. For instance, shares of Tesla are listed on the Nasdaq exchange, and can be purchased through any major broker. Another option is to invest in funds that track Elon Musk’s portfolio, such as the ARK Innovation ETF. These types of funds are managed professionally and often have a more diversified portfolio, which can mitigate some of the risk associated with investing in a single company.

Tax Implications

It is important to keep in mind that investing in companies owned by Elom Musk may come with certain tax implications. For example, profits from the sale of stock in a Musk-owned company will be subject to capital gains taxes, just like any other asset. Additionally, any dividends paid out by the company may also be subject to taxes. It is important to speak with a tax professional prior to investing in any of Musk’s companies to make sure that you are aware of all the potential tax implications.

Conclusion

As one of the world’s most successful entrepreneurs, Elon Musk has a number of highly successful companies in his portfolio. These companies may offer investors the opportunity to benefit from new and innovative technologies, as well as potentially lucrative investments in the long run. However, it is important to remember that there are risks associated with investing in companies owned by Musk, and it is always a good idea to consult with a financial advisor or tax professional prior to investing.