Elon Musk is the mastermind behind multiple successful companies, including Tesla, SpaceX, and The Boring Company. Since 2007, when Tesla stock began trading, the company has seen incredible success. Tesla has grown to become the most valuable car company in the world and Elon Musk has become one of the most wealthy businessmen in the world.

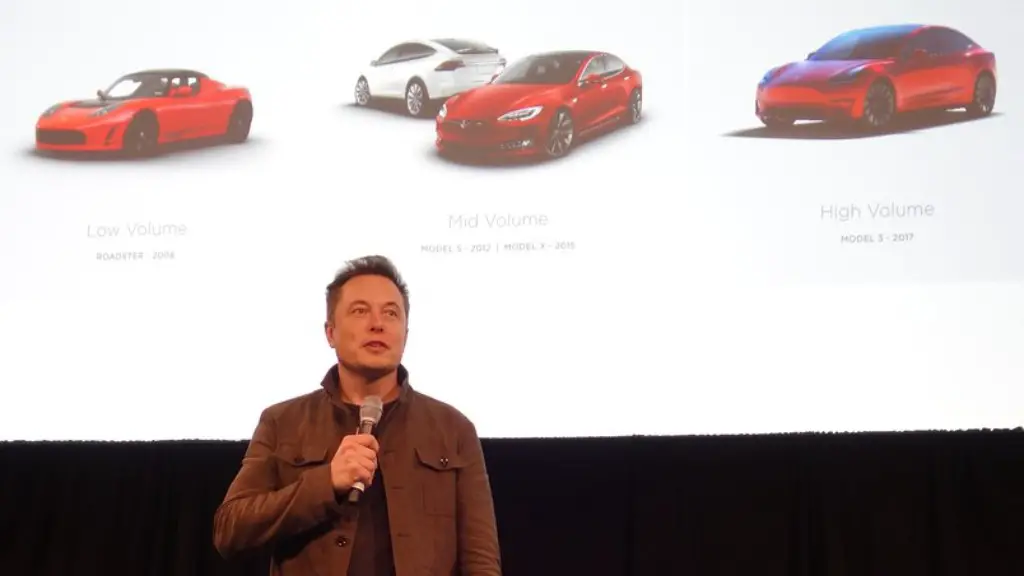

The surge in valuation of Tesla also rode on the back of Elon Musk’s visionary leadership. Musk’s strategy for Tesla has been to continuously invest in new technologies, expand production, develop new products and invest heavily in research and development. He has also embraced the idea of using cutting edge technology to disrupt the traditional auto industry.

However, despite the success of Tesla and Elon Musk, the shares of the company have been volatile in recent times. This volatility has been driven by a mixture of factors, including Elon’s mercurial behaviour, rising competition, and a disconnect between the company’s performance and stock price.

There has been much speculation as to why Elon Musk decided to sell some of his shares in Tesla. One of the most commonly cited reasons is that he wanted to diversify his investments and reduce his risk exposure. It is also likely that he was looking to raise capital for other investments, such as his extraterrestrial ambitions of colonizing Mars.

From a different perspective, some experts speculate that Elon Musk was cashing out because he had already realized a significant return from Tesla. Many believe that Musk was able to time his exit from Tesla perfectly, cashing out with enough to capitalise on other investments.

The Opportunities for Tesla

Tesla’s potential for future growth is undeniable. Tesla’s revolutionary products have already made waves in the automotive industry, creating a whole new market for sustainable cars with cutting-edge technology. Moreover, as the company continues to expand, it will find more opportunities to innovate, diversify, and create a competitive advantage.

Tesla is also well-positioned to take advantage of the growing global demand for green, sustainable vehicles. As the world moves towards a more environmentally friendly, low-carbon future, Tesla is one of the few companies that can provide a viable solution to the growing climate crisis. With its strong technological and engineering capabilities, Tesla is well-placed to take advantage of this new market.

Finally, with Elon Musk at the helm, Tesla is well-placed to capitalise on the many opportunities awaiting it. Musk has already proved himself to be an able leader and a masterful innovator. With his vision and direction, Tesla is poised to become one of the most successful companies of the 21st century.

The Challenges Facing Tesla

Tesla is not without its challenges. Firstly, the company faces fierce competition from traditional automotive companies such as BMW, Mercedes and Volkswagen, who now all have electric vehicles of their own. Additionally, Tesla faces growing competition from smaller, agile competitors such as Lucid and NIO and startups like Rivian.

Moreover, the electric vehicle market is still in its infancy and Tesla is only just beginning to scratch the surface. There is still a lot of work to be done in terms of research and development, marketing and distribution, and manufacturing. Tesla also faces significant regulatory hurdles, such as emissions regulations and safety requirements.

Finally, Elon Musk himself is an unpredictable figure, who can often cause controversy with his erratic behaviour. This can create unease among investors and potential partners, making it harder for Tesla to capitalize on its potential.

Elon Musk’s decision to sell some of his Tesla shares had a significant impact on the company’s stock price, as it caused the stock price to dip slightly. However, despite this, the long-term outlook for Tesla remains very positive, as the electric vehicle market continues to grow and Tesla continues to innovate and develop new products.

Moreover, despite Elon Musk’s decision to sell some shares in the company, Tesla is still heavily reliant on him and his leadership. Elon Musk remains at the helm of the company and continues to drive innovation and growth.

Ultimately, Elon Musk’s decision to sell some of his Tesla shares will likely not have a long-term impact on the company or its stock price. Tesla is well-positioned to continue to disrupt the auto industry and capitalize on the growing demand for electric vehicles.

Will Tesla’s Success Continue?

Tesla’s success in the past few years is undeniable. It has revolutionized the auto industry and provided the world with a viable solution to the developing climate crisis.

However, Tesla’s success is far from guaranteed. Tesla has to contend with growing competition, evolving technological advances, and uncertain government regulations.

Moreover, the future of Tesla may depend on the leadership of Elon Musk. As Tesla’s founder and CEO, Musk has been the driving force behind the company’s success. He has displayed a unique blend of creativity, innovation and vision. But with his unpredictable behaviour and growing competition in the auto industry, it is unclear if he can continue to lead Tesla to success.

Will Tesla Remain Profitable?

Despite the apparent success of Tesla, it is still not a profitable company. Tesla has been unprofitable since its inception and has consistently reported losses. This is due to the company’s high research and development costs and its over-reliance on government subsidies for its electric vehicles.

However, despite these short-term losses, it is likely that Tesla will be able to achieve profitability in the long run. The company has already made significant strides in cost-cutting and automation and with the growing demand for its electric vehicles, Tesla should be able to eventually become profitable.

Moreover, Tesla already has an impressive track record of innovation, with the company regularly introducing new and revolutionary products. This trend is likely to continue in the future, as Tesla continues to innovate and capitalize on opportunities in the electric vehicle market.

What is the Future of Tesla?

The future of Tesla is highly uncertain. On the one hand, it is one of the few companies that can provide a viable solution to the climate crisis and could potentially disrupt the entire auto industry. However, on the other hand, the company has not yet achieved profitability, faces fierce competition and relies heavily on the leadership of Elon Musk.

Nevertheless, despite the uncertainty of the future, Tesla is still a unique and revolutionary company that has already made a significant impact in the global auto industry. As the world moves towards a more sustainable and technologically advanced future, Tesla is likely to remain at the forefront.

Conclusion

Tesla is at an inflection point. The company has revolutionized the auto industry and provided the world with a viable solution to the developing climate crisis. It has grown to become the most valuable car company in the world and Elon Musk has become one of the most wealthy businessmen in the world. Despite short-term losses, it is likely that Tesla will achieve profitability in the long run. With Elon Musk at the helm, Tesla is well-placed to capitalize on the many opportunities awaiting it and remain at the forefront of the global auto industry.