Reasons Behind Elon Musk’s Sinking

The tech-entrepreneur Elon Musk has seen his fair share of success and failure over the years, but can the recent downfall in his net worth be linked to his controversial approach to communication and leadership? There seems to be many factors at play when looking into why there has been a decline in the value of Musk’s shares.

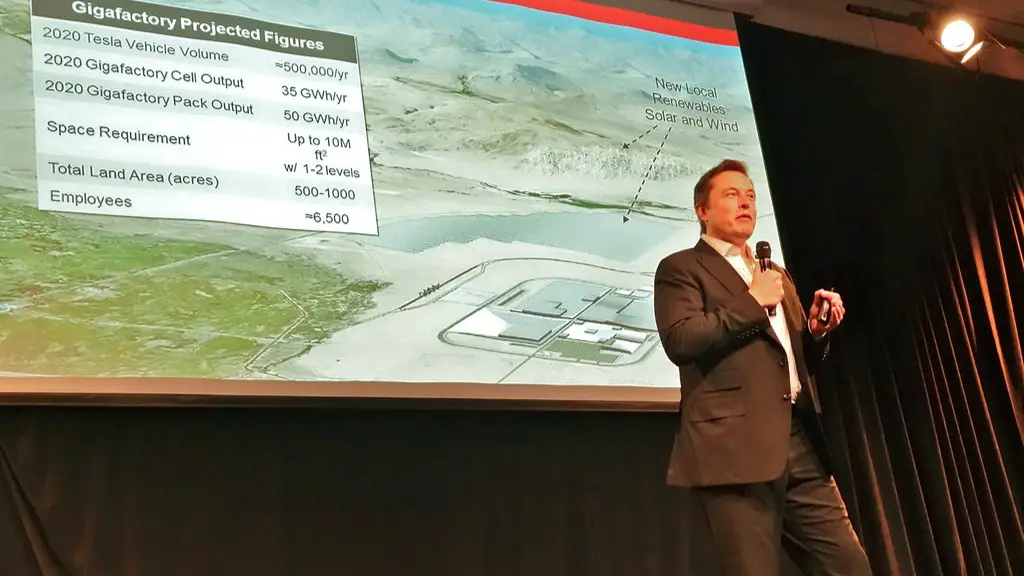

The founding of Tesla, Inc. in 2003 revolutionised the automotive industry but the company has since had a turbulent journey. Producing cheaper, luxury electric cars was just the beginning as the company expanded into solar energy and a host of other technological marvels, but the true heart of musk’s entrepreneurial ethos is the pursuit of sustainable energy to combat climate change. Despite being a respected business figure, musk continues to be the source of much discussion and debate the world over.

A prime example of musk’s volitile behaviour came during the company’s quarterly earnings call with analysts when he refused to answer their questions, choosing instead to address a YouTuber who was randomly selected to ask a question. The incident has been described as ‘masterful manipulation’ of the media and a display of erratic behaviour with many questioning his tactics within the business.

The same quarter saw Musk suing analysts who had criticised Tesla stocks, a move which investors saw as a ‘red flag’ and a sign of his insecurities. This strategy was seen as counterintuitive, as investors want to be to be kept well informed and treated fairly, something which musk seemed reticent to do.

Furthermore, the automotive giant has recalled its cars at various times due to faulty power systems which are thought to be caused by rushed production schedules. These issues have sounded further alarm bells for investors who are concerned about the company’s ability to remain afloat in an already highly competitive market. Musk’s reputation as a businessman appears to be a major factor in the deteriorating value of Tesla shares.

Musk’s recent appointment as the chairman of the board has seen some analysts express concern over his business model which they claim will not yield long term benefits. Musk is known for his unpredictable and reactionary approach to problem solving and communication which although allows him to stay ‘ahead of the curve’ may have a detrimental effect on his company’s future prospects.

Tesla’s Financial Struggles

Tesla Inc. could have been financially secure with its previous $3.5 billion raise. According to reports, the company was considered one of the most heavily-funded in the auto industry. However, due to the long-term cost of producing the vehicles, this technological endeavor has lead to financial worries for Tesla, with ongoing losses reported within the company.

Moreover, the failing battery technologies of Tesla has been a major factor in its declining stock. A lack of quality control on the output of their products has led to faulty machines, thus leading to a recall of all products manufactured prior. This cost the company a considerable amount and cast a long shadow of doubt over the safety of Tesla’s products.

Musk had also made some poor financial decisions in the past, including not fully utilizing the $3.5 billion raise. Many have argued that it could have been invested in better safety and improvement of the cars, thus avoiding the recalls and discouraging customers from buying their vehicles.

Also, Musk’s resistance to report his financial records has left many believing that they are of poor quality. Without releasing the records and making them public, investors will be left in the dark, unable to make informed decisions when investing. Investor unrest could also be seen with Musk’s diversification into solar energy, arguing that he is not focusing enough on the core competencies of the company.

Elon Musk’s Communication Style

Musk’s decision making and communications are a major cause of his company’s sinking. Being the CEO of a major auto company, Musk has taken a bold stance on his forms of communication, which could be seen as brash and insulting. He has even gone as far as to call some of his critics ‘frauds’, which has led to some feeling uncomfortable in their interactions with the tech entrepreneur.

Furthermore, Musk has courted controversy with his frequent twitter outbursts, which arguably have negative effects on the company’s future prospects. The tweets about controversial topics such as the SEC, Saudi Arabia and short sellers, have not gone down well with the industry. Such tweets call into question his capabilities to lead, leading investors to worry about his control of the tech giant.

Also, Musk has, on various occasions, gone against the advice of his board members, choosing instead to pursue his own agenda. This behaviour has been highlighted in the SEC lawsuit, wherein Musk was accused of defying the agreements initially put in place which limited his ability to make major decisions for the company.

Tesla’s stock prices have also been affected because Musk does not provide investors with truthful information. He has made several statements that have misled shareholders, prompting the SEC to file a lawsuit against him. Musk was found guilty and had to pay a fine of $20 million, causing instability in the minds of investors and decreased stock prices.

Tesla’s Board of Directors

The decision making of Tesla’s board of directors has been questionable in the past few months. Although the board members have the experience necessary to make informed decisions, they have failed in their duty to take into account the views of investors.

The board has also been criticized for not having any effective process for monitoring Elon Musk’s actions as well as not effectively communicating his intentions to shareholders. For example, Musk announced his plan to take Tesla private, something that did not receive appropriate approval from the board.

The board has also been faulted for failing to implement a proper risk assessment framework. This has put the company in a position where it has accepted risks for the sake of a short term gain, disregarding the long term effects of those decisions.

Furthermore, the board has failed to enforce consequences to Musk’s erratic behaviour. Musk’s lack of respect for shareholders has been brushed aside and his numerous outbursts have failed to be addressed. This lack of control has caused many investors to doubt the board’s ability to lead the tech giant.

Analysts’ Opinions

Analysts have been critical of Elon Musk’s decisions and communication, believing that they are largely to blame for Tesla’s sinking stocks. Many argue that Musk’s lack of respect for investors has damaged the company’s reputation and have cited his frequent twitter outbursts as the primary cause.

Furthermore, analysts have been quick to point out Musk’s reluctance to answer questions during quarterly earnings calls as a major factor in the company’s downfall. They believe that this indicates his lack of confidence and unwillingness to take criticism, which investors view as worrying signs.

It has been recommended that Musk takes a friendlier approach with analysts and investors alike. If he is to regain the trust of stakeholders and improve the value of shares, Elon Musk will need to adhere to their requests and provide a transparent platform for communication.

Moreover, analysts have argued that Musk does not have a solid long term strategy for success for the company. His risk taking behaviour has been the source of concern, with Tesla’s perpetual reliance on investors being seen as a large problem.

Analysts suggest that he focuses on the development of other cutting edge products away from the automotive industry and build relationships with other companies to create synergy. This could prove to be beneficial in not only bringing in large investments to the company but also with allow unique opportunities to succeed.

Conclusion of Musk’s Sinking

It cannot be argued that Elon Musk has made tremendous strides towards revolutionizing the automotive industry, with Tesla Inc. providing a platform for technological advancements in sustainable energy and other forms of transportation. However, it is clear that the recent sinking in value of Musk’s shares is largely due to his inconsistent and uncomfortable approach to communication as well as an apparent lack of long term business strategy.

Furthermore, the poor decision making of the Tesla’s board of directors has been a key factor in the company’s volatility within the stock markets. Investors are simply not comfortable with the current operation of the company which is likely why there has been a consistent decline in the value of Musk’s shares.

Undoubtedly, though, a large factor in the recent downfall of Musk’s net worth is his unwillingness to release financial records, thus leading to questions of probity. Musk needs to take a step back and consider his current approach to running a business if he is to regain trust of investors. Although his entrepreneurial ethos may be admirable, his volatility may be the company’s ultimate downfall.