Elon Musk, founder, CEO and CTO of SpaceX, CEO and product architect of Tesla Inc., and founder of The Boring Company, has recently made some exciting investments in the stock market – particularly in the automotive and space industry. One of his latest investments is Tesla Inc.’s stock. Tesla has been on Elon Musk’s radar ever since its inception. With the company’s impressive sales figures and its recent advances in the electric vehicle market, it’s no wonder that Musk has chosen to invest in this stock.

Tesla’s stock, which trades under the ticker symbol TSLA, has risen steadily over the past few months as the company has posted improved financial results. Since the beginning of 2021, the stock has increased by almost 50 percent. Tesla’s share price has hit an all-time high of $638.40 as of early March 2021.

As one of Tesla’s major shareholders, Elon Musk has a vested interest in the company’s success. He bought a large amount of Tesla’s stock in 2020 and has continued to buy more in 2021. Musk has also been active on social media and in the news to promote Tesla’s products and services. This is a testament to his commitment to the company and its stock.

Tesla has been a part of Musk’s plan for years. He began building a factory in Nevada in 2014 that produces electric vehicles. In the summer of 2016, Tesla announced plans to build a Gigafactory, a state-of-the-art factory for electric vehicle battery production. Since then, Tesla has continued to invest in research and development for its cutting-edge electric vehicles. Tesla has also announced plans to build a new factory in Austin, Texas, which is expected to double the company’s current production capacity.

Tesla has also made many strides in the space industry. The company has developed and launched its own reusable rockets that have been used to send satellites and other payloads into space. Tesla has recently unveiled its plans to build its own space station and to send a manned mission to Mars by 2024. Musk’s strong interest in space exploration and technology advancement is reflected in his continued investment in Tesla.

Investing in Tesla carries with it a certain amount of risk. At times, the stock price has been volatile, due to the company’s ability to both surprise and disappoint investors. However, many financial experts see Tesla’s stock as a sound long-term investment due to its impressive performance in the electric vehicle market and its commitment to developing cutting-edge technologies. For example, Goldman Sachs has raised its 12-month price target for Tesla to $780 per share, citing the company’s strong operational performance and strong execution of its growth strategy.

Elon Musk’s decision to invest in Tesla’s stock is a strong signal that he believes in Tesla’s long-term success. With Tesla’s impressive performance in both the electric vehicle and space exploration markets, Musk’s investment appears to be well-placed.

Musk’s Impact on Tesla

Elon Musk’s involvement in Tesla has had a major impact on the company. Musk is a visionary leader and has used his technological expertise to lead the company to success. Musk has helped to develop Tesla’s cutting-edge electric vehicles and has taken a hands-on approach to the company’s research and development initiatives. He has also been a key advocate for Tesla in the larger automotive and space exploration markets, pushing for the adoption of Tesla’s innovative technologies.

Musk’s leadership has inspired many people around the world and has encouraged more people to become interested in Tesla’s growth. With his investment in Tesla’s stock, Musk has shown confidence in the company’s future prospects. This commitment has helped to build trust in the company among investors, and has helped to increase its stock price.

In addition to Musk’s commitment to the company, he has also been a vocal supporter of Tesla’s projects. On multiple occasions, Musk has personally taken to social media to voice his support for various initiatives, including the launch of Tesla’s new full-self-driving software and the plans for a human mission to Mars. With his enthusiastic support, Musk has been able to rally media attention and public excitement around Tesla’s projects.

Overall, Elon Musk’s recent investment in Tesla’s stock is a testament to his faith in the company’s potential. His leadership and dedication have been invaluable to Tesla’s success and have helped to build trust among the company’s investors.

Tesla’s Performance Over the Years

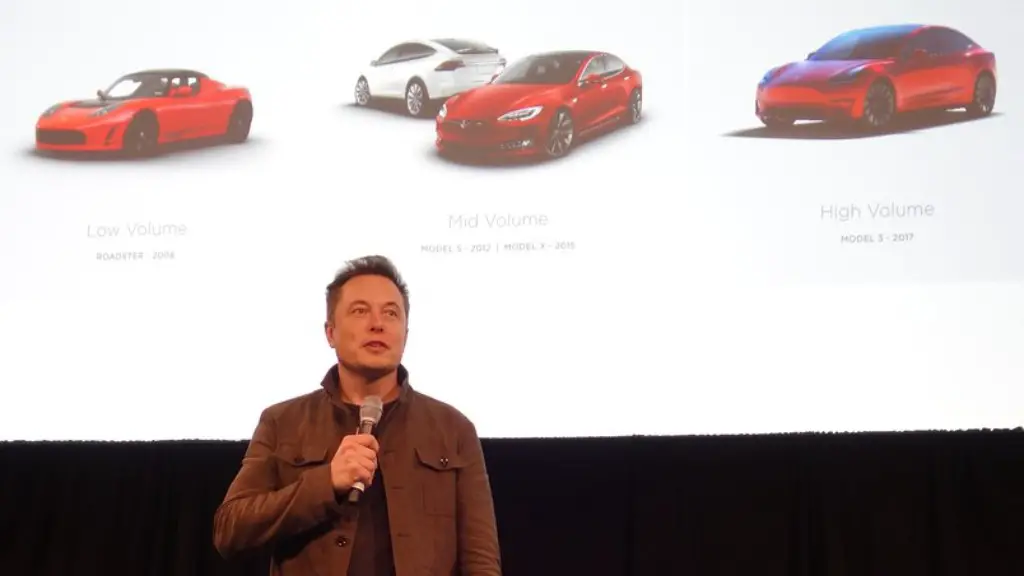

Since its inception, Tesla has achieved considerable success. The company has been able to increase its market share in the electric vehicle market and has become a key player in the global automotive industry. Tesla has launched several new model cars and has opened up new factories in many countries around the world. It has also continued to invest in research and development initiatives in order to stay ahead of the competition.

Tesla’s performance in the stock market has also been impressive. The company’s stock has increased steadily over the past few years and has reached an all-time high of $638.40. Many financial experts have praised Tesla’s strong financial performance and have suggested that the stock is a sound long-term investment.

Tesla’s success in the stock market is a reflection of the company’s overall performance and its commitment to innovation. The company’s commitment to the development of cutting-edge technologies has enabled it to stay ahead of the competition. In addition, Tesla’s strong marketing initiatives have helped to attract more investors and increase its visibility in the market.

Elon Musk’s continued investment in Tesla’s stock is also an indication of the company’s impressive performance. Musk’s commitment to the company has helped to build trust in the company and its stock, which has helped to drive the stock price higher.

Future Prospects for Tesla

Tesla has many exciting projects in the pipeline. The company plans to build a new factory in Texas and is working to develop the next-generation of electric vehicles. The company has also announced plans to build its own space station and to eventually send a manned mission to Mars. These projects have generated a great deal of excitement among investors and have helped to further increase Tesla’s stock price.

Tesla has also been in talks with major automakers about potential partnerships for the development of electric vehicles. These partnerships would provide Tesla with additional access to resources and technology, which could help the company to further refine its current product offerings. This would give Tesla a competitive edge in the market and could potentially help to further increase its stock price.

Tesla also plans to open up new factories in other countries, including India and China. This would enable the company to expand its production capacity and to reach more customers in other countries. It would also increase the company’s revenue, which could be beneficial to the company’s stock price.

Overall, Tesla has a bright future ahead of it. The company’s commitment to innovation and its potential partnerships with other automakers could prove to be major drivers for the company’s growth. Elon Musk’s continued investment in Tesla’s stock is a strong indication of his faith in the company’s potential.

Musk’s Other Investments

In addition to his investment in Tesla, Elon Musk has also invested in a variety of other companies. These investments range from technology companies, to financial companies, to real estate companies. These investments demonstrate Musk’s commitment to a wide variety of sectors and reflect his interest in a broad range of industries.

For example, in 2020, Musk invested in OpenAI, a non-profit artificial intelligence research organization, and in Foundation Medicine, a personalized medicine company. He has also invested in Neuralink, a neuroscience technology company and DeepMind, an artificial intelligence research company. In addition, Musk has made investments in various financial and real estate companies, including Fidelity Investments and The Boring Company.

Musk’s investments in these companies demonstrate his long-term commitment to a variety of industries. His decisions to invest in such a wide range of companies suggests that he is confident in their long-term potential.

Additionally, Elon Musk’s investments have had a major impact on the stock market. His decisions to invest in Tesla, OpenAI, Neuralink and other companies have caused their share prices to rise sharply in recent months.

Overall, Elon Musk’s investments in Tesla and other companies are a testament to his faith in their long-term success. His investments have had a major impact on the stock market and have helped to drive the share prices of these companies higher.

Challenges Faced by Tesla

Despite its impressive performance in the stock market, Tesla still faces some challenges. As Tesla expands its operations, it will need to continue to invest in research and development in order to stay competitive in the electric vehicle market. This could be difficult, as Tesla’s current high share price could make it difficult to receive additional funding.

In addition, Tesla’s future prospects are uncertain. Tesla’s projects have generated a great deal of excitement, but many of them are still in the early stages of development and could take years to come to fruition. This could limit the company’s potential for growth in the short term.

Tesla also faces strong competition from other automakers. Many major automakers have already released electric vehicles and are now competing for market share with Tesla. This could prove to be a difficult challenge for the company as it seeks to stay ahead of the competition.

Finally, Tesla will need to continue to build trust among its investors. Elon Musk’s commitment to the company has been helpful in this regard, but the company needs to continue to demonstrate strong financial performance in order to maintain the trust of its investors.

Overall, while Tesla has seen tremendous success in the stock market, it still faces many challenges. The company needs to continue to invest in research and development, stay ahead of the competition, and build trust among its investors in order to continue its success.